Table of Content

The average 10-year fixed refinance rate right now is 5.99%, a decrease of 6 basis points compared to one week ago. Compared to a 30-year and 15-year refinance, a 10-year refinance will usually have a lower interest rate but higher monthly payment. A 10-year refinance can be a good deal, since paying off your house sooner will help you save on interest in the long run. Just be sure to carefully consider your budget and current financial situation to make sure that you can afford a higher monthly payment. A 15-year fixed-rate mortgage refinance of $300,000 with today’s interest rate of 6.09% will cost $2,546 per month in principal and interest. Over the life of the loan, you would pay $158,313 in total interest.

Consider budgeting for up to 6% of the total cost to refinance your home equity loan, although fees will vary from loan to loan. Lenders have their own internal guidelines used to set rates, so it helps to compare offers from multiple lenders to get the best terms. For example, when the Federal Reserve changes the federal funds rate, the prime interest rate typically increases. So when the prime rate goes up, so do home equity loan rates. Many factors determine the interest rate you’ll pay when you refinance a home equity loan. Unfortunately, some of these factors, such as economic trends, are beyond your control.

How Can I Refinance My Home Loan

When you lock in your rate, ask your lender how long the lock will last. A rate lock can be good for anywhere from 30 to 60 days, which typically will give you enough time to close before the lock expires. If you want to extend the rate lock, ask about fees as many lenders charge a fee for extending a rate lock. For the first five years, a 5/1 ARM will typically have a lower interest rate compared to a 30-year fixed mortgage. Keep in mind that your payment could end up being hundreds of dollars higher after a rate adjustment, depending on the terms of your loan. A rate lock will only last for a set amount of time, typically days.

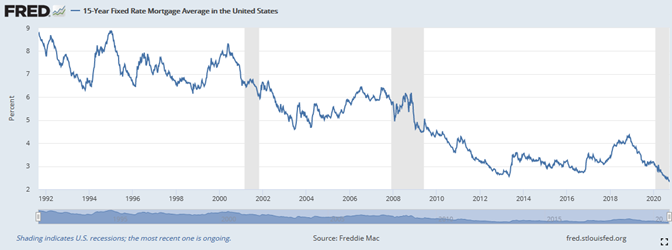

Mortgage rates have been pushed up primarily by the highest inflation in four decades. The consumer price index showed prices up 7.7% year-over-year in October, compared to 8.2% in September. Inflation has remained higher than expected, but appeared to be slowing down in October. If you’re considering using your home equity but have questions about whether it’s a good fit for you, you’ve come to the right place.

Refinance Rates & Loans

Some homeowners choose a home equity loan to finance an expense such as completing a renovation or making another upgrade that will enhance their home’s worth. Get personalized quotes from our marketplace of lenders and negotiate your best rate. If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. Refinancing can be done for many reasons, but switching from an adjustable-rate mortgage to a fixed-rate mortgage is one of the most common.

This can send both your payments and the amount you’re paying to borrow the money up, often with very little notice. If you meet the minimum requirements, refinancing a home equity loan can lower your interest rate and reduce your monthly payments. Of course, if you have a fixed-rate loan and interest rates fall, your principal and interest payments won’t decrease accordingly. Use our mortgage calculator to see how your mortgage payment changes based on causes like your mortgage rate, property taxes, or down payment. The big increase in mortgage rates this year has taken a lot of potential homebuyers out of the market. That could present opportunities for you – if you can afford the higher cost of borrowing money.

New Home Equity Loan

A 5/1 ARM has an average rate of 5.48%, the same rate from the same time last week. A 5/1 ARM has an average rate of 5.48%, which is an addition of 1 basis point compared to last week. The average 30-year fixed mortgage interest rate is 6.63%, which is a growth of 12 basis points from last week. A mortgage term is the length of time you have to repay your mortgage loan. Although there is no set time frame, the custom within the real estate industry is that mortgage pre-approval is valid for between 90 to 180 days.

This is especially useful if you are having trouble keeping up with the current monthly instalments. If you are having trouble keeping up with payments, extending your loan tenure may help ease the strain. You can extend your home loan tenure anywhere up to 35 years in total.

How much does it cost to sell your home?

Also, entering a new draw period makes it easy to keep borrowing. If you’re refinancing because you’re concerned about repaying your existing HELOC, adding to your debt will only make your financial situation more tenuous. Also, the more home equity you have, the lower your interest rate will tend to be.

That’s compared to 6.66% from last week and the 52-week low of 6.62%. You may be able to get more affordable monthly payments on your HELOC through refinancing, whether into a new HELOC, a home equity loan, or a new first mortgage. Explore your options by applying with several lenders and comparing their offers. See which possibility gives you the best combination of short-term affordability and long-term stability. If refinancing isn’t an option, ask your servicer about a loan modification. Perhaps the most common reason why borrowers refinance is to access lower mortgage rates.

Before refinancing your home loan, make sure you have all the necessary information. This will include things like your current balance, monthly instalments, tenure, fees, and interest rates. ROSHI is one of Singapore’s leading comparison aggregators and an independent loan marketplace.

If you're concerned about receiving marketing email from us, you can update your privacy choices anytime in the Privacy and Security area of our website. We ask for your ZIP code because we need to know your time zone so we can call you during the appropriate business hours. A step-by-step guide to refinancing If you've been thinking of refinancing your home loan, but don't know where to start, here's a step-by-step guide to help you.

Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors. Mortgage rates move up and down on a daily basis, and it’s impossible to time the market. So locking in your interest rate right now is a good idea because overall, rates are historically favorable. Getting loan offers from two or three lenders is a great way to get the lowest interest rate.

Though mortgage rates are not set by the central bank, its rate hikes increase the cost of borrowing money and eventually impact mortgage and refinance rates and the broader housing market. Whether refinance rates will continue to rise or fall will depend largely on how things play out with inflation. But if inflation remains high, we could see refinance rates maintain their upward trajectory. Interest rates, loan terms, and extra taxes and fees influence your mortgage for the life of your loan. But borrowers have to deal with closing costs before finalizing a new purchase or refinance. The longer you put it off, the more interest you’ll pay over time.

What Costs Come with Refinancing a Home Loan?

Refinancing into a lower interest rate fixed-rate loan reduces the amount of interest you pay over time. While there are potential advantages of refinancing a mortgage to a fixed-rate loan, keep in mind that refinancing isn't for everyone, as individual situations differ. With a fixed-rate loan, you can plan for a stable housing payment. Make sure you have a clear understanding of the annual cap and the lifetime cap on your ARM.

It’d be a lump sum of cash — so you’re not tempted to over-spend or rack up more debt. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Figuring out how much home equity you have is a great first step to leveraging it to accomplish your financial goals. You need a large amount of upfront cash, such as for a major home repair or vehicle purchase. Escrow is a legal arrangement where a third party temporarily holds money on behalf of a buyer and seller in a real estate transaction.

No comments:

Post a Comment